3 Most Common Mutual Fund Investment Misconceptions Busted

According to data from AMFI, the assets under management of the Indian mutual fund industry stood at ₹19.04 lakh crore on 30 May 2017. In the past 10 years, the AUM of the industry has gone up by six times, from ₹3.26 trillion in March 2007 to ₹19.04 trillion in May 2017.

That is a lot of money invested in mutual funds. Despite these big numbers, it is safe to say that Indians don’t invest in mutual funds as much as they should.

We believe that while more and more investors are finding mutual funds to be favorable investment options, the transition towards them is still slow because of some misconceptions that people have about mutual funds. Let’s clear them.

1: Mutual funds are high-risk investments

The truth is that mutual funds help you reduce risks. In fact, investing in the stock market is risky and unfortunately the same perception has been associated with equity mutual funds. But that’s a myth. Mutual funds help you diversify your investments across sectors and stocks, bringing down the risk greatly. Treat a mutual fund as a long-term investment and you will make money!

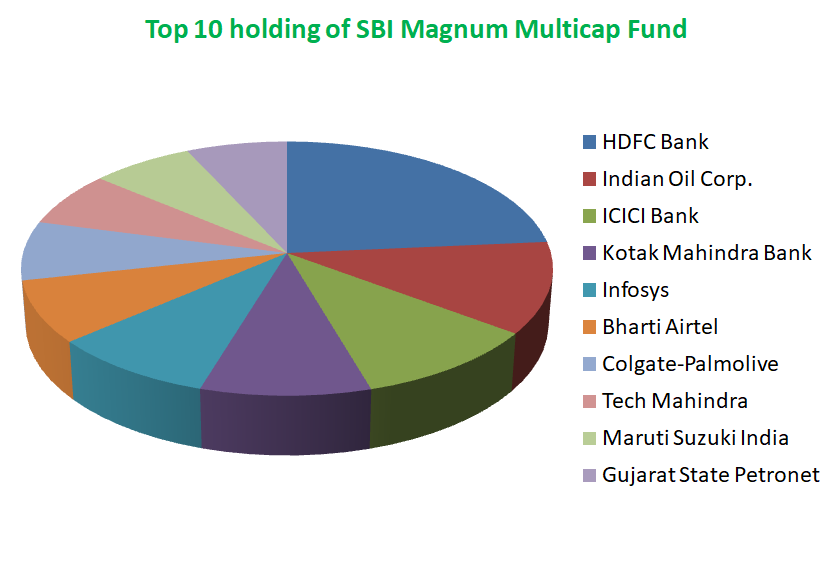

The image below shows the portfolio of SBI Magnum Multicap fund. Typically, a diversified mutual fund has holdings in a number of stocks across a number of sectors. Hence, the issues of any one of the stocks doesn’t impact the fund’s performance in a big way. So, the risk is reduced.

2: Mutual funds are complicated

Fixed deposits are easy to understand. You invest your money for a defined period and you get a defined interest rate. It’s true that mutual funds are difficult to understand, but not complicated. Just by putting in a little extra effort to pick a mutual fund to invest in, you can aim for superior tax-efficient and higher returns. Worth the effort for a one-time learning!

And you don’t even have to go for equity funds over FD. You can pick debt funds and earn higher returns.

3: Mutual funds require a lot of money

You will need around ₹4500 to buy one single stock of Britannia, but you can buy exposure to a large number of companies in one go by starting just a ₹1000 SIP in an equity fund. That’s cool, right? Figure out what you want to invest for and build a portfolio of funds to achieve that goal.

These are some of the common misconceptions that people have about mutual funds. Don’t let them stop you from building wealth over the long-term. Choose mutual funds carefully with the help of an expert, and reap the benefits of the best investments for all time periods.

Drop a mail to buzzmdu@gmail.com in case you need any assistance in investing.